#Large mortgage loans

Explore tagged Tumblr posts

Text

Buy to Let Mortgages | My Local Mortgage Advisor

Looking to invest in property? At My Local Mortgage Advisor, we specialize in Buy to Let mortgages, guiding you through every step to secure the best deal for your investment. Whether you're a first-time landlord or expanding your portfolio, our experts offer tailored advice and support to help maximize your returns. Discover flexible mortgage options and competitive rates today with My Local Mortgage Advisor.

1 note

·

View note

Text

Exploring the Features and Benefits of SBA 7(a) Loans

The SBA 7A program is among the most widely used business financing solutions in the United States. The Small Business Administration provides these loans, which have several features and opportunities that make them a desirable option for business owners.

One of the main advantages of the 7A loans is their flexibility. These can be used for several things, such as refinancing obligations, buying working capital, inventory, or equipment, or even occasionally buying out another business. Moreover, SBA 7A loan interest rates are advantageous. It helps small businesses efficiently control borrowing costs by capping the maximum interest rate that lenders can charge on these loans. Since the interest rates are typically lower than those of traditional lenders, borrowers may end up saving a significant sum of money over time.

There are requirements that business owners must fulfill in order to be eligible for this loan. The SBA 7A loan requirements include that you must be able to repay the loan on schedule, have a strong credit score, and present enough collateral to secure the loan. Read More

#sba loans#SBA 7a loan#Small term loan#Cash Advance#interest rates#equipment financing#Term Loans#mortgage loan#business loan#same day loans online#Large capital Project

1 note

·

View note

Text

Leveraged buyouts are not like mortgages

I'm coming to DEFCON! On FRIDAY (Aug 9), I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On SATURDAY (Aug 10), I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Here's an open secret: the confusing jargon of finance is not the product of some inherent complexity that requires a whole new vocabulary. Rather, finance-talk is all obfuscation, because if we called finance tactics by their plain-language names, it would be obvious that the sector exists to defraud the public and loot the real economy.

Take "leveraged buyout," a polite name for stealing a whole goddamned company:

Identify a company that owns valuable assets that are required for its continued operation, such as the real-estate occupied by its outlets, or even its lines of credit with suppliers;

Approach lenders (usually banks) and ask for money to buy the company, offering the company itself (which you don't own!) as collateral on the loan;

Offer some of those loaned funds to shareholders of the company and convince a key block of those shareholders (for example, executives with large stock grants, or speculators who've acquired large positions in the company, or people who've inherited shares from early investors but are disengaged from the operation of the firm) to demand that the company be sold to the looters;

Call a vote on selling the company at the promised price, counting on the fact that many investors will not participate in that vote (for example, the big index funds like Vanguard almost never vote on motions like this), which means that a minority of shareholders can force the sale;

Once you own the company, start to strip-mine its assets: sell its real-estate, start stiffing suppliers, fire masses of workers, all in the name of "repaying the debts" that you took on to buy the company.

This process has its own euphemistic jargon, for example, "rightsizing" for layoffs, or "introducing efficiencies" for stiffing suppliers or selling key assets and leasing them back. The looters – usually organized as private equity funds or hedge funds – will extract all the liquid capital – and give it to themselves as a "special dividend." Increasingly, there's also a "divi recap," which is a euphemism for borrowing even more money backed by the company's assets and then handing it to the private equity fund:

https://pluralistic.net/2020/09/17/divi-recaps/#graebers-ghost

If you're a Sopranos fan, this will all sound familiar, because when the (comparatively honest) mafia does this to a business, it's called a "bust-out":

https://en.wikipedia.org/wiki/Bust_Out

The mafia destroys businesses on a onesy-twosey, retail scale; but private equity and hedge funds do their plunder wholesale.

It's how they killed Red Lobster:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

And it's what they did to hospitals:

https://pluralistic.net/2024/02/28/5000-bats/#charnel-house

It's what happened to nursing homes, Armark, private prisons, funeral homes, pet groomers, nursing homes, Toys R Us, The Olive Garden and Pet Smart:

https://pluralistic.net/2023/06/02/plunderers/#farben

It's what happened to the housing co-ops of Cooper Village, Texas energy giant TXU, Old Country Buffet, Harrah's and Caesar's:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

And it's what's slated to happen to 2.9m Boomer-owned US businesses employing 32m people, whose owners are nearing retirement:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

Now, you can't demolish that much of the US productive economy without attracting some negative attention, so the looter spin-machine has perfected some talking points to hand-wave away the criticism that borrowing money using something you don't own as collateral in order to buy it and wreck it is obviously a dishonest (and potentially criminal) destructive practice.

The most common one is that borrowing money against an asset you don't own is just like getting a mortgage. This is such a badly flawed analogy that it is really a testament to the efficacy of the baffle-em-with-bullshit gambit to convince us all that we're too stupid to understand how finance works.

Sure: if I put an offer on your house, I will go to my credit union and ask the for a mortgage that uses your house as collateral. But the difference here is that you own your house, and the only way I can buy it – the only way I can actually get that mortgage – is if you agree to sell it to me.

Owner-occupied homes typically have uncomplicated ownership structures. Typically, they're owned by an individual or a couple. Sometimes they're the property of an estate that's divided up among multiple heirs, whose relationship is mediated by a will and a probate court. Title can be contested through a divorce, where disputes are settled by a divorce court. At the outer edge of complexity, you get things like polycules or lifelong roommates who've formed an LLC s they can own a house among several parties, but the LLC will have bylaws, and typically all those co-owners will be fully engaged in any sale process.

Leveraged buyouts don't target companies with simple ownership structures. They depend on firms whose equity is split among many parties, some of whom will be utterly disengaged from the firm's daily operations – say, the kids of an early employee who got a big stock grant but left before the company grew up. The looter needs to convince a few of these "owners" to force a vote on the acquisition, and then rely on the idea that many of the other shareholders will simply abstain from a vote. Asset managers are ubiquitous absentee owners who own large stakes in literally every major firm in the economy. The big funds – Vanguard, Blackrock, State Street – "buy the whole market" (a big share in every top-capitalized firm on a given stock exchange) and then seek to deliver returns equal to the overall performance of the market. If the market goes up by 5%, the index funds need to grow by 5%. If the market goes down by 5%, then so do those funds. The managers of those funds are trying to match the performance of the market, not improve on it (by voting on corporate governance decisions, say), or to beat it (by only buying stocks of companies they judge to be good bets):

https://pluralistic.net/2022/03/17/shareholder-socialism/#asset-manager-capitalism

Your family home is nothing like one of these companies. It doesn't have a bunch of minority shareholders who can force a vote, or a large block of disengaged "owners" who won't show up when that vote is called. There isn't a class of senior managers – Chief Kitchen Officer! – who have been granted large blocks of options that let them have a say in whether you will become homeless.

Now, there are homes that fit this description, and they're a fucking disaster. These are the "heirs property" homes, generally owned by the Black descendants of enslaved people who were given the proverbial 40 acres and a mule. Many prosperous majority Black settlements in the American South are composed of these kinds of lots.

Given the historical context – illiterate ex-slaves getting property as reparations or as reward for fighting with the Union Army – the titles for these lands are often muddy, with informal transfers from parents to kids sorted out with handshakes and not memorialized by hiring lawyers to update the deeds. This has created an irresistible opportunity for a certain kind of scammer, who will pull the deeds, hire genealogists to map the family trees of the original owners, and locate distant descendants with homeopathically small claims on the property. These descendants don't even know they own these claims, don't even know about these ancestors, and when they're offered a few thousand bucks for their claim, they naturally take it.

Now, armed with a claim on the property, the heirs property scammers force an auction of it, keeping the process under wraps until the last instant. If they're really lucky, they're the only bidder and they can buy the entire property for pennies on the dollar and then evict the family that has lived on it since Reconstruction. Sometimes, the family will get wind of the scam and show up to bid against the scammer, but the scammer has deep capital reserves and can easily win the auction, with the same result:

https://www.propublica.org/series/dispossessed

A similar outrage has been playing out for years in Hawai'i, where indigenous familial claims on ancestral lands have been diffused through descendants who don't even know they're co-owner of a place where their distant cousins have lived since pre-colonial times. These descendants are offered small sums to part with their stakes, which allows the speculator to force a sale and kick the indigenous Hawai'ians off their family lands so they can be turned into condos or hotels. Mark Zuckerberg used this "quiet title and partition" scam to dispossess hundreds of Hawai'ian families:

https://archive.is/g1YZ4

Heirs property and quiet title and partition are a much better analogy to a leveraged buyout than a mortgage is, because they're ways of stealing something valuable from people who depend on it and maintain it, and smashing it and selling it off.

Strip away all the jargon, and private equity is just another scam, albeit one with pretensions to respectability. Its practitioners are ripoff artists. You know the notorious "carried interest loophole" that politicians periodically discover and decry? "Carried interest" has nothing to do with the interest on a loan. The "carried interest" rule dates back to 16th century sea-captains, and it refers to the "interest" they had in the cargo they "carried":

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

Private equity managers are like sea captains in exactly the same way that leveraged buyouts are like mortgages: not at all.

And it's not like private equity is good to its investors: scams like "continuation funds" allow PE looters to steal all the money they made from strip mining valuable companies, so they show no profits on paper when it comes time to pay their investors:

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

Those investors are just as bamboozled as we are, which is why they keep giving more money to PE funds. Today, the "dry powder" (uninvested money) that PE holds has reached an all-time record high of $2.62 trillion – money from pension funds and rich people and sovereign wealth funds, stockpiled in anticipation of buying and destroying even more profitable, productive, useful businesses:

https://www.institutionalinvestor.com/article/2di1vzgjcmzovkcea8f0g/portfolio/private-equitys-dry-powder-mountain-reaches-record-height

The practices of PE are crooked as hell, and it's only the fact that they use euphemisms and deceptive analogies to home mortgages that keeps them from being shut down. The more we strip away the bullshit, the faster we'll be able to kill this cancer, and the more of the real economy we'll be able to preserve.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/08/05/rugged-individuals/#misleading-by-analogy

#pluralistic#leveraged buyouts#lbos#divi recaps#mortgages#weaponized shelter#debt#finance#private equity#pe#mego#bust outs#plunder#looting

428 notes

·

View notes

Text

just embracing it at this point, lads

cw: fluff, slight confessions, cuddling, based on original animal crossing

pairing: Tom Nook/Reader

It was difficult to resist the big eyes of the little tanuki whom you had grown close to. When Nook had threatened you with his goons jokingly after you finished working for him, you had truly thought he meant it entirely as a falsity. Yet, it seemed that he did have some “goons.” Granted, they both seemed far too sweet to actually do anything like that. Though, if Nook did raise them as he had claimed… You felt certain they might actually be capable of doing that.

You served them cake with a sigh, watching as they greedily devoured their individual slices. It seemed they had little to do when Nook was working long hours, so it had become a habit to visit you and see if you would play with them. The two were easy to entertain and fascinated by most things. Though, you were not entirely sure if you enjoyed their comments on the benefits of a larger home for you. Something told you Nook had really rubbed off on them. Still, they were far from a burden, and it was nice to have company. The older tanuki had become a frequent visitor to your home, too. Well, for more than just reminders to pay your loan. Picking up the twins had become a part of his evening routine. They often lost track of time which made Nook have to head over to retrieve them.

Both blinked at you as you sat at the table in your thoughts. Timmy spoke first, opting to bring back your focus. “… What do you think of Mr. Nook… Nook?” Tommy's voice trailed after him. Both seemed curious about the same thing. You glanced at them. Well, he was a bit of a hard ass at first. Seriously, you did not expect to have a mortgage jousted onto you when you moved to a new town. Granted, it did not have interest and no due-by date, but… He also forced you to work part-time and got huffy when you did not want to what the uniform. Your revenge had been banging on his door at three in the morning, claiming you had things to sell. It was shocking he opened the door in his pyjamas and told you that he would only pay seventy percent for it.

But… He had his good sides. He still did give you a home to live despite only having a thousand bells to hand off, and he was courteous enough to still be pleasant with you. The way he cared for Timmy and Tommy… And, well… Maybe, secretly, you would admit that he was a bit cute. Those tired eyes and his comforting way of speaking… You often found yourself hanging out his store for more than just tools. Though, you could not just tell these children those things!

“… He is a good businessman,” you replied simply. They both idolised him and wished to learn from his, after all. That was a good enough reply, assuredly. Both seemed to blink while gazing at you with their large eyes.

“Do you like him… him?” they both asked. You swallowed. What in the world was this? Did they suspect your feelings? It was beyond stressful that your feelings were so obvious that these kids could see them. You grew a bit flustered and looked away. The two shared a glance and nodded at each other. “Mr. Nook likes you, too… too!”

You tensed up. Huh?! Nook liked… you? Surely, they were messing with you. Nook had warned you himself that they could be quite mischievous. Though… They did not appear to doing anything of the sort. Why… were they telling you this? You swallowed again. Nook… You did feel quite strongly for him, but you had this feeling he was not the type to be overly interested in romance. Especially not from a tenant of his. “This isn't some joke, is it?” you asked the two.

Both leaned towards you with their eyes even wider. It seemed that, no, this was not a joke. They were informing you of the truth. “We want you and Mr. Nook to be together!” Timmy explained. Tommy nodded. You grew even more flustered. What was this?! Yet… You could not entirely say you were disinterested. You shook your head at the boys.

“Well…” You tried to politely scold them for being so involved, but their pleading eyes silenced you. They seemed to have made their wants known. Maybe… you could try. Finally, you gave a nod, and they both seemed to perk up. They thanked you for the cake and asked you to walk them home. Thus, giving you a moment with Nook.

~

The shopkeeper received the twins back easily, heading to close the shop while you lingered for a moment inside. He glanced at you, seemingly waiting for you to either leave or say something. You knew he was tired. Nook'N'Go's hours were no joke. It had become slightly common for you to bring him food to eat on his shift since you worried about his health a bit. Though, he seemed fine otherwise.

“Nook…” You spoke finally, “Er, Tom, rather.” He perked up at your choice of his first name and shut the door to the shop while flipping the sign. It seemed he understood you were not there to shop any longer. He took his cap and walked over to you, opting to give you his full attention in between his closing duties. “... I…” it was quite difficult to tell the man what should have been so easy. He gave a 'hm' in reply. “I was wondering if you could set aside some time… for us to… get a coffee together?” you offered awkwardly.

“I don't see why not, hm?” he nodded, “That sounds quite nice. I think I will, yes, yes.”

It seemed it was the beginning of something for you.

Maybe you could even convince him to knock some bells off your debt.

(Unlikely, alas.)

~

A few months from there, you found yourself asleep in a bed with Nook. Snow had crept in with the winter. Somehow, you had found yourself sleeping over at the little living unit in the shop the tanuki lived in. You shifted into his side as the chill of the morning crept under the covers. An arm held you closer to him. The warmth that ruminated from him kept you contented. It seemed you had not been tricked by twins about his feelings. He genuinely had come to like you and appreciated your aid with the boys. It had not been long after that your relationship turned into something more romantic.

Honestly, his off-comment suggestion about you moving in was not so bad. Though, you wondered if that would mean you would be freed from your mortgage. With what a cheapskate he was, you doubted it. You clutched onto his pyjamas and nuzzled into his chest.

You both would have continued to sleep in had the pitter-patter of smaller feet had not approached Nook's bedroom and knocked on the door. You both rose up from the embrace to glance at the door. It seemed Timmy and Tommy were awake. A yawn came from Nook as he stretched and moved to get ready for the day. You managed to catch him just before he did and press a kiss to his cheek. Pulling away, you called out, “Morning… love you…”

He nodded back at you. “Good morning, dear,” he leaned forward to peck a kiss to your forehead. His cheek rubbed against your own make you giggle. “I love you, too,” he moved to actually get dressed.

#animal crossing x reader#tom nook x reader#tom nook/reader#animal crossing/reader#ac tom nook x reader

37 notes

·

View notes

Text

The Oldest Known Firearm in the U.S. Found in Arizona

Independent researchers in Arizona have unearthed a bronze cannon linked to the 16th-century expedition of Francisco Vázquez de Coronado, and it is marked to be the oldest known firearm found in the continental United States.

The 42-inch-long, roughly 40-pound sand-cast bronze cannon was discovered at the location of a Spanish stone-and-adobe structure in the Santa Cruz Valley that is thought to have been a part of the short-lived settlement San Geronimo III.

To finance an expedition to North America in 1539, Vázquez de Coronado took out large loans and mortgaged his wife’s possessions. The Spanish conquistador and his 350 soldiers intended to locate the legendary (and nonexistent) Seven Cities of Gold north of Mexico. By 1541, they had reached southern Arizona, where they established a settlement they called San Geronimo III, or Suya. San Geronimo was the first European town in the American Southwest.

Rather than accumulating immense wealth, Coronado and his men plied, and spent the next three years plundering, enslaving, and murdering their way across the region. These transgressions did not go unanswered. In the predawn hours of one fateful morning in 1541, the native Sobaipuri launched a surprise attack on the town. Many settlers were killed in their beds, and the survivors fled in disarray. The cannon — meant to intimidate and protect — was never even loaded.

Although Coronado was bankrupt and facing war crime charges when his expedition came to an end in Mexico City, his impact on North America would last for many generations.

One site in particular has produced a large number of artifacts associated with the explorers, according to the authors of a study published on November 21st in the International Journal of Historical Archeology. Researchers found European pottery, weapon parts, including a 42-inch-long bronze cannon, and glass and olive jar fragments in the ruins of a stone and adobe building in Arizona’s Santa Cruz Valley.

“Not only is it the first gun ever recovered from the Coronado expedition, but consultation with experts throughout the continent and in Europe reveal that it is also the oldest firearm ever found inside the continental USA,” Archaeologist Deni Seymour explained.

The early firearm also called a wall gun, was typically used as a defensive weapon positioned on a wooden tripod on fortification walls and required two operators. However, in Coronado’s case, such a cannon would have been used offensively, typically to pierce the weaker walls of buildings in Indigenous communities.

Archaeologists were able to date the cannon to Coronado’s time using radiocarbon dating and optically stimulated luminescence techniques, and the other artifacts matched descriptions of the supplies and possessions of his expedition. However, the wall gun’s simple casting suggests that, in contrast to more elaborate Spanish cannons, it might have been built in Mexico or the Caribbean—and possibly even acquired from Ponce de León’s previous expedition.

By Oguz Kayra.

#The Oldest Known Firearm in the U.S. Found in Arizona#Francisco Vázquez de Coronado#San Geronimo III#wall gun#bronze#bronze gun#bronze canon#ancient artifacts#archeology#archeolgst#history#history news#ancient history#ancient culture#ancient civilizations#spanish conquistador#spanish explorer#spanish history

26 notes

·

View notes

Text

Ko-Fi prompt from Isabelo:

Hi! I'm new to the workforce and now that I have some money I'm worried it's losing its value to inflation just sitting in my bank. I wanted to ask if you have ideas on how to counteract inflation, maybe through investing?

I've been putting this off for a long time because...

I am not a finance person. I am not an investments person. I actually kinda turned and ran from that whole sector of the business world, at first because I didn't understand it, and then once I did understand it, because I disagreed with much of it on a fundamental level.

But... I can describe some factors and options, and hope to get you started.

I AM NOT LEGALLY QUALIFIED TO GIVE FINANCIAL ADVICE. THIS IS NOT FINANCIAL ADVICE.

What is inflation, and what impacts it?

Inflation is the rate at which money loses value over time. It's the reason something that cost 50 cents in the 1840s costs $50 now.

A lot of things do impact inflation, like housing costs and wage increases and supply chains, but the big one that is relevant here is federal interest rates. The short version: if you borrow money from the government, you have to pay it back. The higher the interest rates on those loans, the lower inflation is. This is for... a lot of reasons that are complicated. The reason I bring it up is less so:

The government offers investments:

So yeah, the feds can impact inflation, but they also offer investment opportunities. There are three common types available to the average person: Bonds, Bills, and Notes. I'll link to an article on Investopedia again, but the summary is as follows: You buy a bill, bond, or note from the government. You have loaned them money, as if you are the bank. Then, they give it back, with interest.

Treasury Bills: shortest timeframe (four weeks to a year), and lowest return on investment. You buy it at a discount (let's say $475), and then the government returns the "full value" that the bond is, nominally (let's say $500). You don't earn twice-yearly interest, but you did earn $25 on the basis of Loaning The Government Some Cash.

Treasury Notes: 2-10 year timeframe. Very popular, very stable. Banks watch it to see how they should plan the interest rates for mortgages and other large loans. Also pretty high liquidity, which means you can sell it to someone else if you suddenly need the cash before your ten-year waiting period is up. You get interest payments twice a year.

Treasury Bonds: 20-30 years. This is like... the inverse of a house mortgage. It takes forever, but it does have the highest yield. You get interest payments twice a year.

Why invest money into the US Treasury department, whether through the above or a different government paper? (Savings bonds aren't on sold the set schedule that treasury bonds are, but they only come in 30-year terms.)

It is very, very low risk. It is pretty much the lowest risk investment a person can make, at least in the US. (I'm afraid I don't know if you're American, but if you're not, your country probably has something similar.)

Interest rates do change, often in reaction or in relation to inflation. If your primary concern is inflation, not getting a high return on investment, I would look into government papers as a way to ensure your money is not losing value on you.

This is the website that tells you the government's own data for current yield and sales, etc. You can find a schedule for upcoming auctions, as well.

High-yield bank accounts:

Savings accounts can come with a pretty unremarkable but steady return on investment; you just need to make sure you find one that suits you. Some of the higher-yield accounts require a minimum balance or a yearly fee... but if you've got a good enough chunk of cash to start with, that might be worth it for you.

They are almost as reliable as government bonds, and are insured by the government up to $250,000. Right now, they come with a lower ROI than most bonds/bills/notes (federal interest rates are pretty high at the moment, to combat inflation). Unlike government papers, though, you can deposit and withdraw money from a savings account pretty much any time.

Certificates of Deposit:

Okay, imagine you are loaning money to your bank, with the fixed term of "I will get this money back with interest, but only in ten years when the contract is up" like the Treasury Notes.

That's what this is.

Also, Investopedia updates near-daily with the highest rates of the moment, which is pretty cool.

Property:

Honestly, if you're coming to me for advice, you almost definitely cannot afford to treat real estate as an investment thing. You would be going to an actual financial professional. As such... IDK, people definitely do it, and it's a standby for a reason, but it's not... you don't want to be a victim of the housing bubble, you know? And me giving advice would probably make you one. So. Talk to a professional if this is the route you want to take.

Retirement accounts:

Pension accounts are a kind of savings account. You've heard of a 401(k)? It's that. Basically, you put your money in a savings account with a company that specializes in pensions, and they invest it in a variety of different fields and markets (you can generally choose some of this) in order to ensure that the money grows enough that you can hopefully retire on it in fifty years. The ROI is usually higher than inflation.

These kinds of accounts have a higher potential for returns than bonds or treasury notes, buuuuut they're less reliable and more sensitive to market fluctuations.

However, your employer may pay into it, matching your contribution. If they agree to match up to 4%, and you pay 4% of your paycheck into an pension fund, then they will pay that same amount and you are functionally getting 8% of your paycheck put into retirement while only paying for half of it yourself.

Mutual Funds:

I've definitely linked this article before, but the short version is:

An investment company buys 100 shares of stock: 10 shares each in 10 different "general" companies. You, who cannot afford a share of each of these companies, buy 1 singular share of that investment company. That share is then treated as one-tenth of a share of each of those 10 "general" companies. You are one of 100 people who has each bought "one stock" that is actually one tenth of ten different stocks.

Most retirement funds are actually a form of mutual fund that includes employer contributions.

Pros: It's more stable than investing directly in the stock market, because you can diversify without having to pay the full price of a share in each company you invest in.

Cons: The investment company does get a cut, and they are... often not great influences on the economy at large. Mutual funds are technically supposed to be more regulated than hedge funds (which are, you know, often venture capital/private equity), but a lot of mutual funds like insurance companies and pension funds will invest a portion of their own money into hedge funds, which is... technically their job. But, you know, capitalism.

Directly investing in the stock market:

Follow people who actually know what they're doing and are not Evil Finance Bros who only care about the bottom line. I haven't watched more than a few videos yet, but The Financial Diet has had good energy on this topic from what I've seen so far, and I enjoy the very general trends I hear about on Morning Brew.

That said, we are not talking about speculative capital gains. We are talking about making sure inflation doesn't screw with you.

DIVIDENDS are profit that the company shares to investors every quarter. Did the company make $2 billion after paying its mortgages, employees, energy bill, etc? Great, that $2 billion will be shared out among the hundreds of thousands of stocks. You'll probably only get a few cents back per stock (e.g. Walmart has been trading at $50-$60 for the past six months, and their dividends have been 57 cents and then 20.75 cents), but it adds up... sort of. The Walmart example is listed as having dividends that are lower than inflation, so you're actually losing money. It's part of why people rely on capital gains so much, rather than dividends, when it comes to building wealth.

Blue Chip Stocks: These are old, stable companies that you can expect to return on your investment at a steady rate. You probably aren't going to see your share jump from $5 to $50 in a year, but you also probably won't see it do the reverse. You will most likely get reliable, if not amazing, dividends.

Preferred Stocks: These are stock shares that have more reliable dividends, but no voting rights. Since you are, presumably, not a billionaire that can theoretically gain a controlling share, I can't imagine the voting rights in a given company are all that important anyway.

Anyway, hope this much-delayed Intro To Investing was, if not worth the wait, at least, a bit longer than you expected.

Hey! You got interest on the word count! It's topical! Ish.

#economics#capitalism#phoenix talks#ko fi#ko fi prompts#research#business#investment#finance#treasury bonds#savings bonds#certificate of deposit#united states treasury#stocks#stock market#mutual funds#pension funds

68 notes

·

View notes

Text

Ian Millhiser at Vox:

The Supreme Court delivered a firm and unambiguous rebuke to some of America’s most reckless judges on Thursday, ruling those judges were wrong to declare an entire federal agency unconstitutional in a decision that threatened to trigger a second Great Depression. In a sensible world, no judge would have taken the plaintiffs arguments in CFPB v. Community Financial Services Association seriously. Briefly, they claimed that the Constitution limits Congress’s ability to enact “perpetual funding,” meaning that the legislation funding a particular federal program does not sunset after a certain period of time. The implications of this entirely made-up theory of the Constitution are breathtaking. As Justice Elena Kagan points out in a concurring opinion in the CFPB case, “spending that does not require periodic appropriations (whether annual or longer) accounted for nearly two-thirds of the federal budget” — and that includes popular programs like Social Security, Medicare, and Medicaid.

Nevertheless, a panel of three Trump judges on the United States Court of Appeals for the Fifth Circuit — a court dominated by reactionaries who often hand down decisions that offend even the current, very conservative Supreme Court — bought the CFPB plaintiffs’ novel theory and used it to declare the entire Consumer Financial Protection Bureau unconstitutional. In fairness, the Fifth Circuit’s decision would not have invalidated Social Security or Medicare, but that’s because the Fifth Circuit made up some novel limits to contain its unprecedented interpretation of the Constitution. And the Fifth Circuit’s attack on the CFPB still would have had catastrophic consequences for the global economy had it actually been affirmed by the justices. That’s because the CFPB doesn’t just regulate the banking industry. It also instructs banks on how they can comply with federal lending laws without risking legal sanction — establishing “safe harbor” practices that allow banks to avoid liability so long as they comply with them.

As a brief filed by the banking industry explains, without these safe harbors, the industry would not know how to lawfully issue loans — and if banks don’t know how to issue loans, the mortgage market could dry up overnight. Moreover, because home building, home sales, and other industries that depend on the mortgage market make up about 17 percent of the US economy, a decision invalidating the CFPB could trigger economic devastation unheard of since the Great Depression. Thankfully, that won’t happen. Seven justices joined a majority opinion in CFPB which rejects the Fifth Circuit’s attack on the United States economy, and restates the longstanding rule governing congressional appropriations. Congress may enact any law funding a federal institution or program, so long as that law “authorizes expenditures from a specified source of public money for designated purposes.”

[...]

Notably, the Supreme Court’s CFPB decision was authored by Justice Clarence Thomas, who is ordinarily the Court’s most conservative member. The fact that even Thomas delivered such an unambiguous rebuke to the Fifth Circuit is a sign of just how far the lower court went off the rails in its decision.

Two justices did dissent: Justice Samuel Alito, the Court’s most reliable GOP partisan, and Justice Neil Gorsuch, who also dissented in a similar case that could have triggered an economic depression if Gorsuch’s view had prevailed. Alito’s dissenting opinion is difficult to parse, but it largely argues that the CFPB is unconstitutional because Congress used an unusual mechanism to fund it.

SCOTUS ruled 7-2 in CFPB v. Community Financial Services Association that the Consumer Financial Protection Bureau is constitutional, delivering a big rebuke to the ultra-radical right-wing 5th Circuit Court. The author of this ruling is Clarence Thomas.

#SCOTUS#CFPB v. Community Financial Services Association#CFPB#Consumer Financial Protection Bureau#Clarence Thomas

43 notes

·

View notes

Text

so, let me see if i can trace this history for you. first (you'll see it's not at all the first but let's start here), the dotcom bubble. a large number of highly funded startup internet corporations preached promises about the immediate leap in quality of life they were about to cause. this was mostly a ruse to fool their credulous peers into generating venture capital, and just when the thing was about to pop, something unexpected happened. a mild, unassuming search engine named after a number figured out how to monetize the large dataset its unprofitable business was based on by using it to direct targeted advertising. suddenly every internet company who didn't figure out how to do this was dead

next, the housing bubble. the similarities are a bit hard to trace but let me see if i can outline them. a large number of highly funded fintech corporations preached promises about the immediate leap in quality in life they were about to cause (by selling overpriced houses to people who couldn't afford them and changing the available credit rating of the loans by bundling them into packets by the millions, called mortgage backed securities). this was mostly a ruse to fool their credulous peers into generating investment revenue, and just when the thing was about to pop, nothing unexpeted happened. nobody invented a crucial, game-changing innovation, and the whole thing was at risk of collapse. so, naturally, the government apologized to them and bailed everybody out, because that's not how business-tier capitalism is supposed to work

currently, we're doing another one. in retrospect it's probably going to become called some incredibly stupid industry term, like "the compute bubble." we spend a lot of time talking about AI, but i'm not sure who would win between the three if you compared capital outlay against quantum computing and datacenters. which one spent the most? (probably not quantum computing.) which one made the most? (probably datacenters.) is it that straightforward? (no, AI happens at datacenters)

anyway, a large number of highly funded compute corporations preached promisess about the immediate leap in quality of life they were about to cause. this was mostly a ruse to fool their credulous peers into generating revenue, and just when the thing was about to pop -- well, i guess you'll have to tune in next week, huh? this week's radio show has been sponsored by the eternal inflation model of cosmology. do you worry about what's going to happen to your profit margins after the heat death of the universe? stop that! and come on down to the eternal inflation megachurch

24 notes

·

View notes

Note

AITA for being a successful entrepreneur?

I am a humbly wealthy shopowner with my two nephews as employees. I’ve had many businesses in small towns and villages over the years and worked my way up from a independent business owner working 13 hours a day to an internationally recognized brand name. I’ve even owned my own house remodeling business at one point! Yes, yes! Things have never been better and I’m so happy that I can provide for my nephews! 🎵

But apparently some people think I’m a scammer. See, by virtue of being one of the only shops in wherever I set up, I also essentially controlled the housing market. If someone needed a house, or wanted to do anything with it, I was the ra—erm, man for the job. And I do admit that, in the past, by businesses practices hadn’t always been kind, especially in this one little 🌳animal forest🌳. I like to think that I’ve grown, though. 😸

I only learned news of this complaint once I started my latest business venture: transforming a barren, deserted island into a paradise. It was wildly successful, and every single person that bought my getaway package loved it! 💰

Except for a few.

In every island I’ve been a part of, and even in the towns of the past, there’s always someone that complains. It’s just gotten very difficult to contend with over the past four years. Oddly, it’s usually a certain group with large, round heads and a liking for furniture. I’ve been called many horrible names over the years specifically for the mortgaging options I provide… 😿

Every house is offered on a buy-first-pay-whenever-you-want system. It’s a zero-interest loan with no conditions other than you pay off your house if you want me to make it bigger. That’s one of the fairest deals in the world! No rent, no monthly payments, just take out the loan and live your life! ✨

How is that a scam?! Of course the prices aren’t cheap, I’m practically giving you an entire house for free! Yes, yes! It’s the perfect deal! 🏆

It’s quite the 🌎 wild world 🌎 out there, but entrepreneurial 🏙city folk🏙 like me have to make ends meet somewhere! On the offchance that I am the asshole, though, I’m more than willing to turn over a 🍃new leaf! 🍃 After all, it’s my personal mission to keep an open mind and find 🏝new horizons🏝 to grow.

Much love, ❤️

T.N.

25 notes

·

View notes

Text

i have spent four months talking to my mortgage broker every single week. hello norman, i say on mondays, let's talk about my loan again. i understand it but i am afraid of it. it is the single biggest promise i have made to anyone who i do not also kiss. this morning, less than one week after closing, i got a call from the bank. well, i thought to myself, this is it. i did not understand the loan. they are going to take back my home. i deserve this for making such a comically large promise.

turns out it was just an automated call to say "hi :') we're your bank :') we love you :') welcome to your loan :')"

22 notes

·

View notes

Text

OCs as Good Roommates

Had a prompt sent my way by @sorcerous-caress , hopefully I got it right? It got pretty rambly.

Mina

One of those roommates you get in college, probably the best out of the bunch and the one who's usually followed up by the roommate from hell.

She lives part-time at the dorm, so you do have a large chunk of privacy by default. You find out she's an RN student with very odd hours, but she’s very respectful about your peace/sleep, like a mouse she's in and out. On the rare occasion that you've been startled by her scurrying about, she's quick to smooth things over by finding that one midnight snack you've been craving? How'd she know? It's like she can read your mind.

During the beginning of the semester, Mina offers to find you cheaper textbooks, physical or digital it doesn't matter; even those non-standard textbooks professors write themselves. Mina manages to find them dirt cheap or even free and gifts them to you. Just ignore some stains and copper smell, she uh, got them from some family associates.

She's a god send during midterms or when you're sick, healthy snacks, easy to read study guides, and enough medicine for anything you need; you'd think she's a walking pharmacy. You don't know how she does it, but somehow you're healthy almost immediately. You'll miss her when she's gone and are pretty sure she's going to be a wonderful nurse.

Felicia Aguilar

Felicia, is that the roommate you get when you're down on your luck; You find her by chance on a web listing, and apparently, she needed a roommate for a year. Supposedly her apartment is too quiet during the day? Whatever that means.

It's a little awkward at first, but Felicia offers to help carry your heavier items up the elevator and starts to organize for you; However, you'll get the impression she is more used to being leered at rather than talked to. As you gradually get settled in, you'll notice how clean everything is; at least, that's one thing you don't have to worry about.

Most of the apartment is already decorated, and you come to find out Felicia has a child(divorced)? Who lives part-time with her. You're free to decorate the living space as you please, save Felicia's room. The only stipulation is that you don't touch her child's room/plants. ( A week after you move in, you discover the "child" is a whole-ass college kid. How old is Felicia?)

She tends to be very busy most nights and tries to be as respectful as possible for it. You don't get much conversation out of her because of it, but the few moments you do talk, it's mostly her picking your brain about music. After a few convos, she'll start gifting you with albums or tickets for artists you mentioned. She tries to memorize what you like, at least for small talk purposes

Felicia keeps the fridge stocked, and she actually urges you to eat from it often. It's almost as if she doesn't eat and just buys groceries for appearances, but hey, at least someone eats them. Just don't open her ice box. She's very territorial over it for some reason.

Catalina

Catalina is the odd one out here because they actually own the place you room together. You find them from flyers, actually, old-fashioned, but it got the job done.

When you move in, it becomes very apparent that the situation is a case of empty nest syndrome on Catalina's part. A couple of off-handed remarks about grandchildren moving out(they don't seem that old)? And complaints about the lack of noise, paint a picture of a begrudgingly lonely individual.

Your half of the rent is dirt cheap, as Catalina covers the majority of the mortgage, and for what you get access to, it's really a steal on your end. A large master bedroom with a private on-suite bathroom and a large plot of land that Catalina doesn't care what you do with. They'll even throw in the offer of loaning one of their work trucks.

Catalina doesn't care about noise. Hell, they'll even courage it. It's your living space, live in it dammit.

Pets are okay, Catalina even has some of their own on the property. The pets are terrifying, but they are friendly to you. ( you swear you've seen one of the dogs walk around like a skinless man once.) Catalina will feed your pets for you, and take them out for exercise( they might come home with an animal carcass or two. Catalina just flatly states your pet is a good hunter, with no elaboration.)

You don't have to worry about house maintenance, whether it's yard work, plumbing, or even electrical. Catalina has you covered. She will grab you if you're nearby, however, just to teach you. You're not going to live with them forever and it's good to be self-sufficient. Now be good and grab the wrench for them.

6 notes

·

View notes

Text

J.5.6 Why are mutual credit schemes important?

Mutual credit schemes are important because they are a way to improve working class life under capitalism and ensure that what money we do have is used to benefit ourselves rather than the elite. By organising credit, we retain control over it and so rather than being used to invest in capitalist schemes it can be used for socialist alternatives.

For example, rather than allow the poorest to be at the mercy of loan sharks a community, by organising credit, can ensure its members receive cheap credit. Rather than give capitalist banks bundles of cash to invest in capitalist firms seeking to extract profits from a locality, it can be used to fund a co-operative instead. Rather than invest pension schemes into the stock market and so help undermine workers pay and living standards by increasing rentier power, it can be used to invest in schemes to improve the community and its economy. In short, rather than bolster capitalist power and so control, mutual credit aims to undermine the power of capitalist banks and finance by placing as much money as much possible in working class hands.

This point is important, as the banking system is often considered “neutral” (particularly in capitalist economics). However, as Malatesta correctly argued, it would be “a mistake to believe … that the banks are, or are in the main, a means to facilitate exchange; they are a means to speculate on exchange and currencies, to invest capital and to make it produce interest, and to fulfil other typically capitalist operations.” [Errico Malatesta: His Life and Ideas, p. 100] Within capitalism, money is still to a large degree a commodity which is more than a convenient measure of work done in the production of goods and services. It can and does go anywhere in the world where it can get the best return for its owners, and so it tends to drain out of those communities that need it most (why else would a large company invest in a community unless the money it takes out of the area handsomely exceeds that put it?). It is the means by which capitalists can buy the liberty of working people and get them to produce a surplus for them (wealth is, after all, “a power invested in certain individuals by the institutions of society, to compel others to labour for their benefit.” [William Godwin, The Anarchist Writings of William Godwin, p. 130]). From this consideration alone, working class control of credit and money is an important part of the class struggle as having access to alternative sources of credit can increase working class options and power.

As we discussed in section B.3.2, credit is also an important form of social control — people who have to pay their mortgage or visa bill are more pliable, less likely to strike or make other forms of political trouble. Credit also expands the consumption of the masses in the face of stagnant or falling wages so blunting the impact of increasing exploitation. Moreover, as an added bonus, there is a profit to be made as the “rich need a place to earn interest on their surplus funds, and the rest of the population makes a juicy lending target.” [Doug Henwood, Wall Street, p. 65]

Little wonder that the state (and the capitalists who run it) is so concerned to keep control of money in its own hands or the hands of its agents. With an increase in mutual credit, interest rates would drop, wealth would stay more in working class communities, and the social power of working people would increase (for people would be more likely to struggle for higher wages and better conditions — as the fear of debt repayments would be less). By the creation of community-based credit unions that do not put their money into “Capital Markets” or into capitalist Banks working class people can control their own credit, their own retirement funds, and find ways of using money as a means of undermining capitalist power and supporting social struggle and change. In this way working people are controlling more and more of the money supply and using it in ways that will stop capital from using it to oppress and exploit them.

An example of why this can be important can be seen from the existing workers’ pension fund system which is invested in the stock market in the hope that workers will receive an adequate pension in their old age. However, the only people actually winning are bankers and big companies. Unsurprisingly, the managers of these pension fund companies are investing in those firms with the highest returns, which are usually those who are downsizing or extracting most surplus value from their workforce (which in turn forces other companies to follow the same strategies to get access to the available funds in order to survive). Basically, if your money is used to downsize your fellow workers or increase the power of capital, then you are not only helping to make things harder for others like you, you are also helping making things worse for yourself. No person is an island, and increasing the clout of capital over the working class is going to affect you directly or indirectly. As such, the whole scheme is counter-productive as it effectively means workers have to experience insecurity, fear of downsizing and stagnating wages during their working lives in order to have slightly more money when they retire (assuming that they are fortunate enough to retire when the stock market is doing well rather than during one of its regular periods of financial instability, of course).

This highlights one of the tricks the capitalists are using against us, namely to get us to buy into the system through our fear of old age. Whether it is going into lifelong debt to buy a home or putting our money in the stock market, we are being encouraged to buy into the system which exploits us and so put its interests above our own. This makes us more easily controlled. We need to get away from living in fear and stop allowing ourselves to be deceived into behaving like “stakeholders” in a Plutocratic system where most shares really are held by an elite. As can be seen from the use of pension funds to buy out firms, increase the size of transnationals and downsize the workforce, such “stakeholding” amounts to sacrificing both the present and the future while others benefit.

The real enemies are not working people who take part in such pension schemes. It is the people in power, those who manage the pension schemes and companies, who are trying to squeeze every last penny out of working people to finance higher profits and stock prices — which the unemployment and impoverishment of workers on a world-wide scale aids. They control the governments of the world. They are making the “rules” of the current system. Hence the importance of limiting the money they have available, of creating community-based credit unions and mutual risk insurance co-operatives to increase our control over our money which can be used to empower ourselves, aid our struggles and create our own alternatives (see section B.3.2 for more anarchist views on mutual credit and its uses). Money, representing as it does the power of capital and the authority of the boss, is not “neutral” and control over it plays a role in the class struggle. We ignore such issues at our own peril.

#community building#practical anarchy#practical anarchism#anarchist society#practical#faq#anarchy faq#revolution#anarchism#daily posts#communism#anti capitalist#anti capitalism#late stage capitalism#organization#grassroots#grass roots#anarchists#libraries#leftism#social issues#economy#economics#climate change#climate crisis#climate#ecology#anarchy works#environmentalism#environment

10 notes

·

View notes

Note

Hello, Sam! I’m one of your neighbours, and I’m presently job hunting, coming out of a professional services career. I’ve been eyeing work in the nonprofit sector, and was wondering if you have any advice on entering you might share? I am aware it doesn’t typically pay the way for-profit tends to, which is fine; Chicago’s COL is Chicago’s COL, though, and can I reasonably expect to be able to continue to live in the city?

Hey fellow Chicagoan!

So, it kind of depends on a couple of factors, like what jobs you're looking at in the nonprofit sector, which nonprofit you end up with, and what your current COL is in Chicago. I was living...comfortable-ish on $55K/yr, but I was in a cheap one-bedroom rental situation and had reduced-fee student loans, no partner or children, and was used to living very cheaply. I now earn roughly $75K/yr with a mortgage and no student loans, but I still had to put a few things on credit to do the Europe trip (since paid off). For context, after taxes $75K a year is roughly $5K/mo, of which I get about $2.5K/mo after mortgage and bills (including vision and dental insurance, which I don't get through my work).

I work for a small nonprofit of about 35 people (about half in fundraising) with a yearly fundraise of $10M or so. I was actually far less well-compensated at my last job, which was a massive organization with a 200-person fundraising team alone. But if you're coming from for-profit your best bet is still to look at large orgs, like United Way or UIC or similar. I know from experience the museums in Chicago, while delightful, generally have to pay somewhat below industry standard (when I changed jobs from a $55K to a $75K job, the Art Institute was offering $40K for the same position).

Without knowing your previous industry and where you're looking to land it's tough to offer useful information, but it is possible to live in Chicago, even in downtown, and work for a nonprofit, it just depends on other factors. And I don't have a ton of info on what other non-fundraising people who work at nonprofits get paid. :/

If you like, feel free to hit me up at [email protected] and I'm happy to get more specific; I can also pass along some good jobsearch websites for specifically the nonprofit field. But I would definitely start by researching larger nonprofits, either local to Chicago or national with Chicago branches, and checking out comp salaries in your field.

56 notes

·

View notes

Text

reigen definitely strikes me as the kind of guy who wants to take care of everything, and i think it's largely because he doesn't have any adult friends. even when serizawa comes in, serizawa is an adult but he doesn't know how to do a lot of adult things because of the way he lived for so long before working for claw and then working under reigen. i don't think he understands how insurance works, or credit, or taking out a loan, or refinancing your car or a mortgage or any of that shit.

because of this, he really does see himself as The Responsible Adult in most situations, so he takes care of everything. because once again, 99% of his friends are the gaggle of teenagers that mob brings around, *of course* they don't understand insurance, they're like 14 years old *max*.

he sees himself as The Responsible Adult, leading to situations like what he was trying to do with the members of claw before mob accidentally transferred his powers to him--he was trying very hard to leave the kids out of it so they didn't have to deal with these grown-up freaks, because he knows damn well kids shouldn't have to deal with things like this, of course adults should be more responsible than this. and that's another reason he tried to get mob and everyone to run away, even if that was nowhere near a viable option for them.

this is part of what draws me to reigen, the way he switches in and out of situations, what makes him such a multifaceted character.

to himself, he's a responsible adult, or an adult that should be more responsible because he's an adult. he's also a liar, a conman, a cheat. i don't think he genuinely sees himself as a good role model. he probably views himself in a shade of grey, but closer to the black side. i think he carries a lot of guilt and shame for that, and he tries to make up for it, but it never feels like enough to him.

but to mob, he's a person who made some mistakes because he wanted to put food on the table and do/be something interesting, because he doesn't realize how cool he is without having to lie. he's also, despite that, both smart and wise and can be so genuine when he's trying to motivate mob. he's an amazing teacher, not necessarily for his psychic powers, but more so for guiding and leading mob through life when he struggles to understand people and social situations and can be gullible and anxious.

to the former members of the seventh division of claw, he is one of the most powerful psychics in the entire world, who is just as wise as he is powerful, with the kinds of perspectives on life that they couldn't even comprehend. he's someone that deeply humbled them and their childish dreams of world domination, motivating them to strive to be better people, to get involved in their communities instead of chasing after nonsense, helping them realize they're no better than anyone else. that if they're nothing without their powers, then what are they really?

to serizawa, he's one of the guys that helped get him out of claw and into the real world, where he and mob showed him that while his former boss helped him, he wasn't a good person. to serizawa, he's smart. despite being a conman, reigen is someone that serizawa can look up to. even if their methods are somewhat fraudulent, serizawa now has the power to make up for past pain he's caused by helping everyday people with their everyday problems, and even their not-so-everyday problems, and that can get him out of bed in the morning with confidence. to serizawa, reigen was one of the first real friends he's ever had.

reigen definitely doesn't see himself the way that other people see him.

edit: undoubled the last bit T0T

56 notes

·

View notes

Text

A few stories about the Tangerine Tyrant caught my eye today, and they all point to his increasing desperation - so I figured I’d go around the horn and celebrate his continuing dissipation.

First: Criminal Defendant and Adjudicated Rapist Donald Trump yesterday predicted a “bloodbath” if he didn’t get reelected, and the media quickly devolved into outlets condemning his use of violent rhetoric and others - Fox and Newsmax - concern trolling over how he was talking specifically about the automobile industry. So, whatever. If you’re interested in parsing the event along those lines, have at it - but I think there’s a more interesting, deeply indicative phenomenon just below the surface that speaks not just to Trump’s mentality but that of his whole bonkers cult.

If you’re looking for the atavistic pull of Donald Trump on his followers, it’s in his power to do whatever the hell he wants and face no consequences. NO ONE can tell him what to do. NO ONE can keep him from attacking whomever he wants. NO ONE can prevent him from sating his desires. NO ONE.

Now, we know that’s not true - as evidenced by his exile to Mar-a-Lago for the past three years, but it’s part of the mystique. In a lot of ways, it makes sense if you look at his cult following - people who are, by and large, deeply disempowered and enraged at a culture that is stripping away their traditional privileges and social entitlements. They WANT Trump to keep shitting the punch bowl as a sort of wish fulfillment of their own stifled rage. Maybe they can’t rape the woman they want to rape or kill the immigrants they hate for speaking Spanish or Hindi at the Gas-n-Sip – but they sure as hell can dream about it when Trump gives a cross-burner of a speech. That’s all standard form.

But what we saw last night - and in the fascist outrage-trolling today - was something new. It’s been creeping into the 2024 election cycle here and there, but yesterday, it entirely broke through, and it’s this: NOT EVEN TRUMP’S BRAIN IS ALLOWED TO CENSOR TRUMP’S MOUTH WHEN IT COMES TO RAGE AND ANGER.

Look, Trump KNOWS that using words like “bloodbath” is going to cost him non-MAGA voters. He knows that calling people “vermin” is going to hurt his chances of navigating the very narrow path ahead if he hopes to return to the White House. Yet, he can’t stop himself. Trump is unable to act in his own easily achieved best interest if it means not being a monster, and while it’s lamentable that he’s bringing such hatred to our national debate, I encourage him to keep it up.

You be you, Donald!

Every single time you let your id out of its box, it’s like sending America an unsolicited, mushroom-shaped dick-pic. Sure, your fans are going to love it, but the rest of us grossed the fuck out.

So, please! Rage on!

-----

Second:

Trump’s lawyers in the NYS civil fraud case settlement submitted a filing today that it is “a practical impossibility” for Trump to post a bond for the half-billion dollars he needs to cough up in order to appeal the decision. According to reports, he approached 30 different surety companies, and they all turned him down. Why they would do that might indicate what’s got him tuned to “bloodbath” and “vermin” levels of rage.

It might be a simple point, but it bears a paragraph of explanation.

Most folks who don’t work in the NYC real estate market – or any real estate market – might think, “Hey, he’s a rich guy. Why not just sell a few of those buildings he owns? They’ve gotta be worth a pretty penny.”

Or, alternatively, “Why won’t anyone take Trump Tower as collateral for a loan?”

The simple answer is he doesn’t really OWN any of that shit outright. It’s ALL mortgaged to the hilt. To get a clearer picture of this, let’s look at 40 Wall Street – one of Trump’s “prestige” properties.

The numbers are a bit hard to come by, but an hour of reading suggests that the building is presently worth about $200 million. Mind you, part of the fraud charges – now proven – included his valuation of the building in 2015 at over $750 million, but it’s just not worth that at all.

So, take the $200 million as a starting point and note that Trump’s mortgage on the property, according to a Bloomberg report in November of 2023, stands at $122 million. So, if Trump were to liquidate his stake in the property fully, he’d only net about $78 million – and that is BEFORE the capital gains taxes, NYS taxes, and NYC taxes on the sale. According to a few articles I’ve scanned this evening, that would be up to about 40% of his earnings. That means, even if he drops one of his most precious assets, he would only raise about $50 million.

He owes TEN TIMES that number by next week.

Play that out another round, and realize that if Trump tried to sell ten or twenty office buildings in NYC all at once, the price of ALL of them would plummet to fire-sale prices.

He’s fucked. Moreover, he knows it and is desperate to find a way out.

-----

This brings us to news item number three: The Return of Paul Manafort.

News leaked today that Trump is considering bringing convicted felon and former campaign manager Paul Manafort back into his 2024 bid for the White House. Manafort, primarily due to his complete lack of a moral center, would be a tremendous asset for Trump. He’s a solid political operative, but what he REALLY brings to the table is a direct line back to the Russian oligarchy and their money. That, obviously, is an enormous threat to national security, and I’ve got to hope that the intelligence services in DC and around the world will be on heightened alert for any covert – or overt – entreaties to Putin or his cronies for a loan. I’ve got to hope there are ways of making such entreaties known to the public through selective leaks if nothing else.

But that brings us back to observation number one.

Trump knows that going to Putin for help with his financial difficulties if it becomes known, would be a dagger to the heart for his chances of returning to the White House. Yet, if I’m right, he will be unable to stop himself when it comes to finding a fix for his hemorrhaging empire. His brain will tell him this is a terrible idea, but it won’t matter. NO ONE is allowed to stop Donald Trump from doing whatever the hell he wants to do – not even Donald Trump.

In 1776, James Otis, a thoughtful supporter of the Revolutionary War, noted about politics, “When the pot boils, the scum will rise.”

Trump is proving that to be true, even when there’s only one evil, arrogant, rapist bastard in the soup. He’s so screwed.

Love to you all.

Michael J. Tallon

14 notes

·

View notes

Text

The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth.

The Art of Saving Money

One of the toughest challenges for any individual is mastering the art of budgeting and having a consistent amount of savings every month.

I just learned about Kaikebo, a Japanese technique for budgeting that's over 100 years old. It combines mindfulness with spending decisions and helps you simply take control of your finances.

The kakeibo is a simple budgeting journal from Japan that helps you save money by setting goals and tracking spending. It encourages mindful thinking and reflection to improve your saving habits every month.

Kakeibo is a budgeting method that involves tracking every purchase, categorizing spending into needs, wants, culture, and unexpected expenses, and regularly reviewing expenses to track progress toward financial goals. The four categories of spending in kakeibo are needs, wants, culture, and unexpected expenses. Kakeibo is popular because it aligns with the Japanese value of "mottainai" and provides a straightforward way to manage finances.

Saving money is essential in today's fast-paced world for achieving financial independence, planning for life events, and creating a safety net. Developing a habit of saving can give you greater control over your financial future.

Kakeibo, a budgeting technique created by Japanese journalist Hani Motoko in 1904, helps individuals manage monthly expenses, understand spending habits, and practice frugality. It has gained popularity among young individuals for its effectiveness in saving for financial goals and accounting for unexpected costs.

Why i trust japanese art of saving money?

Between 1960 and 1994, Japanese households saved an average of one-sixth of their after-tax income, sometimes reaching nearly one-fourth, significantly higher than the 7.1% average savings rate of American households during the same period. While official statistics indicate that Japanese households are big savers, comparisons can be misleading due to differences in measurement across countries. Adjusting for these discrepancies, it appears that while Japan still saves more than the U.S., the actual difference is smaller than reported. Japan also has a higher savings rate in comparison to other countries, although there are various nations with differing savings behaviours.

Understanding the Kakeibo Method of Budgeting

The Kakeibo method is a Japanese budgeting technique that helps individuals manage their household expenses effectively. Created by journalist Hani Motoko in 1904, Kakeibo encourages mindful spending and can result in savings of up to 35% when practised consistently. The method involves categorizing all expenditures into four main areas: Needs (essential items for survival), Wants (non-essential luxuries), Culture (spending on cultural experiences), and Unexpected expenses (unforeseen costs). Practitioners maintain two notebooks to track their spending—one large notebook for categories and a smaller notebook for jotting down daily expenses. This process instils a sense of accountability and promotes financial discipline, aiding individuals in achieving their savings goals and preparing for emergencies.

How do you use Kakeibo in your life? An individual should use the following steps to incorporate Kakeibo in his life fruitfully:

1. Understand your fixed expenses You start with analyzing the monthly expenses, including your monthly fixed expenses such as rent, utility expenses, loan emis etc.

Fixed expenses are consistent monthly costs that are predictable and easy to incorporate into a budget, unlike variable expenses which fluctuate based on production levels. Key examples of fixed expenses include rent or mortgage payments, car payments, insurance premiums, property taxes, utility bills, child care costs, tuition fees, and gym memberships. To calculate fixed expenses, one should gather their budget or income statement, identify the non-variable expense categories, and sum the amounts from each category. Managing fixed expenses is crucial as they can significantly impact overall spending and understanding these costs can lead to better resource allocation and budgeting decisions

2. Effective Budgeting: Tracking Income and Expenses Here you include all the sources of income you are going to have over the next month. For salaried employees, these include their monthly income, and you also add back the deduction such as health insurance premiums or provident funds that are deducted first before giving you your salary. Non-salaried individuals such as entrepreneurs and freelancers can work with a future income they expect to generate over the next month.

The text outlines the steps necessary for effective budgeting, which includes tracking income and expenses, and comparing the two to ensure spending is managed. Key points include: 1. **Tracking Income**: Monitor gross monthly income, which includes salary and bonuses. To calculate annual gross income, multiply your hourly wage by your weekly hours, then multiply by 52 and divide by 12 for monthly figures. 2. **Tracking Expenses**: Understand fixed costs (e.g., rent, insurance) and flexible expenses (e.g., food, entertainment). Utilize tools such as bank statements and receipts for accurate tracking. 3. **Comparing Income and Expenses**: Subtract total expenses from total income. A positive result indicates that you are spending less than you earn while a negative result shows overspending. 4. **Creating a Budget**: Set financial goals, adjust spending accordingly, and apply budgeting rules like the 50/30/20 rule to effectively allocate your income. This guidance helps individuals maintain financial health by promoting awareness of their earnings and expenditures.

The 50/30/20 Budget Rule with Examples

Explore the power of the 50:30:20 budget rule for effective financial planning. Learn how to manage your money wisely and achieve financial balance using this proven budgeting principle. Take control of your finances and pave the way for financial freedom.

3. Determining Your Ideal Savings Rate

Here you decide how much exactly you wish to save over the next month. The goals should be such that they are not easily achievable or unrealistic that you can’t save anything.

Determining your ideal savings rate is influenced by individual financial situations, lifestyles, and goals. Experts recommend setting aside at least 20% of monthly income for savings, which aids in creating an emergency fund, managing unexpected expenses, and planning for long-term objectives such as retirement.

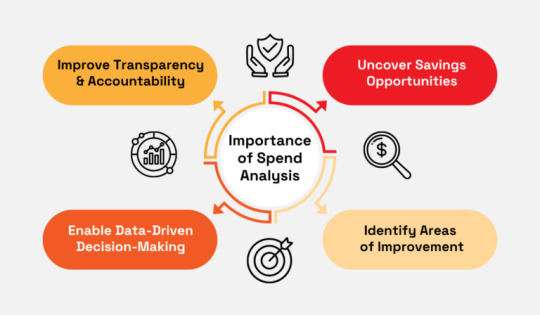

4. Analyze how much you can spend These expenses include all the expenses apart from your fixed expenses. Let’s try to understand all of these with an example. Let us assume you have an Income = 50000 Fixed Expenses (Rent, Utilities etc.) = 20000 Saving Goals = 10000 Then considering the above four points, the amount of money you are left to spend monthly is as follows: The money you can spend = Income – Fixed Expenses – Saving i.e. The money you can spend = 50000 – 20000 – 10000 = 20000 Thus, as an individual with a 50000 income, you are left with 20000 to manage all your expenses apart from your fixed expenses. Spend analysis is a method for understanding spending habits and identifying cost-saving opportunities. 1. Goal Identification: Clearly define what you aim to achieve with spend analysis, whether it's cost reduction or enhancing supplier performance. 2. Data Gathering: Collect all relevant spending data to ensure comprehensive analysis. 3. Data Management: Clean and organize this data to enhance accuracy and usability. 4. Spending Categorization: Group expenditures into categories to facilitate analysis. 5. Trend Analysis: Examine spending patterns to identify trends and recurring expenses. 6. Improvement Opportunities: Highlight areas where costs can be lowered or supplier performance can be enhanced. 7. Ongoing Monitoring: Regularly revisit and update insights to ensure they remain relevant. 8. Cost Reduction: Leverage insights to pinpoint specific areas for spending cuts. 9. Efficiency Improvement: Use findings to streamline operations for better efficiency. 10. Risk Mitigation and Strategic Support: Assess potential risks and utilize insights for informed strategic decision-making regarding investments or expansions.

By analyzing total expenditures, and zeroing in on specific business units, products, quantities, payment terms, and more, you get the answers to four crucial questions: What are we spending money on? Who are we spending it with? Are we getting what we need? Is there a better way to do this? The analysis can either be a comprehensive one or target just different categories of spend. Make your track record up to date regularly.

5. Divide the spending money by 4 The assumption being we have four weeks within a month. As an individual with 20000 spending money, you are allowed to spend a maximum of 5000 every week. Thus it would be best if you restricted your weekly expenses to 5000 such that you do not ever go over budget

The 40/30/20/10 rule is a budgeting method that allocates income into four distinct categories to help individuals manage their finances effectively. Key insights include: 1. Categories Explained:

The rule divides income into needs (40%), discretionary spending (30%), savings or debt repayment (20%), and charitable giving or financial goals (10%).

2. Needs Definition:

The 40% allocated for needs covers essential expenses like rent, mortgage, utilities, and groceries.

3. Discretionary Spending:

The 30% set aside for discretionary spending includes activities such as dining out, entertainment, and shopping.

4. Savings and Debt:

The 20% portion is intended for saving money or paying off existing debts, promoting financial security.

5. Charitable Giving: